Portfolio Details

Lendry

- Category:

- Client:Project Code

Key Features (Expanded)

Key Features:

📄 Loan Origination & Approval

End-to-end workflow for applying, approving, and disbursing loans—automated document

verification, credit checks, and customizable approval rules.

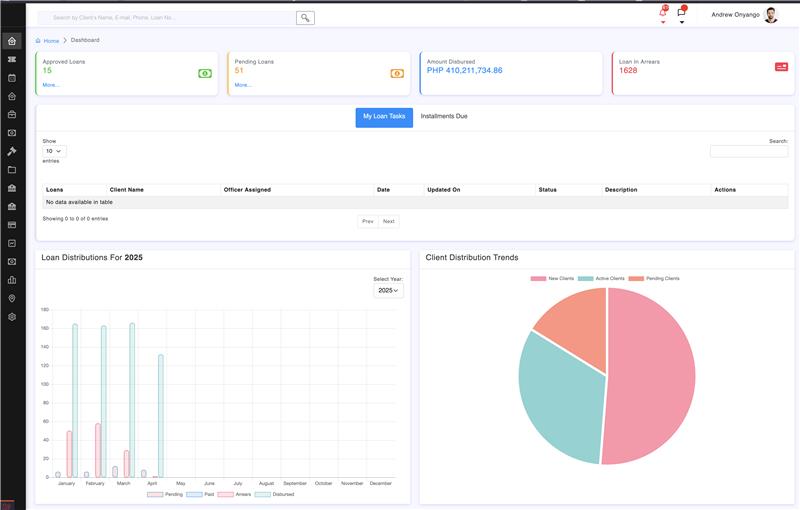

Loan Management Dashboard

View active, pending, and completed loans. Track repayments, interest accruals, and

amortization schedules in real-time.

Payment Scheduling & Reminders

Integrated payment calendar with automatic reminders via SMS/email. Support for

recurring payments and partial payment options.

Credit Scoring System Internal scoring engine based on repayment behavior, income verification, and spending history—used to assess eligibility and adjust interest rates dynamically.

EMI & Interest Calculators Built-in tools for users to simulate monthly payments, total interest, and early repayment benefits.

Transaction History Detailed logs of all user transactions—disbursements, repayments, fees, penalties, and refunds—exportable to Excel/PDF.

Secure Identity Verification (KYC) Support for KYC/AML compliance, including government ID uploads, selfie verification, and address proof, with secure encryption.

Digital Wallet Integration Seamless integration with mobile money (e.g., M-Pesa), bank APIs, and payment gateways to fund loans and process repayments.

Mobile-First UX Optimized for mobile users with a responsive design, making it ideal for underbanked or rural populations accessing via smartphones.

Role-Based User Management Separate interfaces and permissions for Admins, Field Agents, and Borrowers, ensuring secure and efficient workflow.

Fraud Detection Flags Built-in checks to detect suspicious behavior or fraud attempts—such as multiple failed payments, fake documents, or account inconsistencies.

Regulatory Reporting Auto-generated compliance reports for financial authorities (e.g., loan books, NPL ratios, customer KYC stats).